Call US

24/7

Free Confidential case Evaluation

(813)922-0228Call US

24/7

Free Confidential case Evaluation

(813)922-0228Loading...

If you’ve been hurt in Florida, you might find yourself asking, 'What can I recover from all this?' It’s a fair question, and the answer, like most things, isn’t simple. Life is rarely that generous. But the law, in its imperfect way, offers two types of compensation: economic and non-economic damages. We won’t get into punitive damages here, but those are punishment damages that a defendant sometimes has to pay if their conduct was especially egregious or outrageous.

The first is practical, medical bills, lost wages, and the cost of what’s been broken. The second is harder to measure, like trying to hold water in your hands. It’s for the pain you carry, the nights spent staring at the ceiling, the way your world has shifted. Both are real, yet neither can undo what’s been done. Let’s look closer at what’s possible, and how Florida’s laws shape what remains of your fight.

When it comes to economic damages, we're talking about the tangible, out-of-pocket costs you’ve incurred because of your injury—things that you can easily calculate and prove with receipts or bills. These damages are all about covering the actual expenses that have a direct financial impact on your life.

To make things clear, here’s a breakdown of what you might be entitled to:

Past and Current Medical Expenses

This includes any treatment you’ve already received, like emergency room visits, surgeries, physical therapy, or doctor’s appointments. It doesn’t matter if the treatment was in the past or is happening right now—these are all part of the medical expenses you can claim.

And don’t forget about ongoing treatments, like prescription medications or follow-up visits to specialists. These costs add up quickly, and you’re entitled to get reimbursed for them.

Future Medical Expenses

If your injury requires long-term care or future procedures, you’re also entitled to compensation for that. Maybe you need additional surgeries, physical therapy, or home care down the line. Even though you haven’t had those expenses yet, they’re a direct result of your injury, and it’s important to account for them.

Your doctors or medical providers might give a prognosis, recommending certain treatments, and these recommendations can be used to estimate what your future medical bills will look like and help secure compensation.

Lost Wages

If you couldn’t work because of your injury, that lost income is something you can recover. This includes the paychecks you missed out on while you were recovering. Whether you were laid up in bed or spending time at appointments, you shouldn’t be left financially burdened because of time missed from work. Lost wages can also apply if you have to take time off to care for a loved one after their injury.

Future Loss of Earning Capacity

This is where things get a little more complex. If your injury is severe enough that you can't go back to the same type of work you were doing before—whether because of physical limitations or an inability to perform certain tasks—This compensation covers both your current losses and the long-term impact on your ability to work of any individual injured worker in Florida.

For example, Let’s say you were involved in a car crash and suffered a serious knee injury. After months of physical therapy, your doctors determine that you can’t return to your job as a landscaper because your knee won’t handle the physical demands. Now, you’re facing the loss of income because you can’t do your previous job. In this case, you'd be entitled to compensation for your loss of future earning capacity.

Property Damage

If your car, bike, or any other personal property was damaged in the accident, you’re entitled to recover the costs of repairing or replacing it. This could include things like fixing your car after a wreck or replacing your damaged phone or other personal items. Property damage may seem straightforward, but it’s important to keep track of these costs, as they can add up quickly, especially in auto accidents.

In short, these are the bills you can show on paper—the expenses you can back up with receipts, pay stubs, medical records, or repair invoices. They’re the costs that make the difference between getting your life back on track and struggling to get by after an injury.

Now, let's talk about the other side of the coin—non-economic damages. These aren’t the types of damages that you can slap a price tag on, like a hospital bill or a car repair. Instead, these are intangible losses, but they still have a huge impact on your life. And while they’re harder to calculate, they are just as important as the economic damages we talked about earlier.

So, what kind of non-economic damages might you be entitled to?

Pain and Suffering

Pain and suffering is a well-known non-economic damage, covering both the physical pain and mental distress caused by an injury. If your injury leads to chronic pain or ongoing treatments, it can take a serious toll on your body and mind. This pain often lingers well after medical care, affecting everyday life—whether it’s back pain that makes sitting uncomfortable or a knee injury that limits your mobility. It’s the kind of pain you can’t see, but it’s very real.

Loss of Enjoyment of Life

Imagine this—before your injury, you were always the life of the party. You loved playing with your kids, running around at the park, or going out with friends. Now, maybe you can’t even enjoy the simple pleasures you once took for granted. That’s a huge emotional loss, and it’s something that the law recognizes as a real loss. You may be entitled to compensation for the activities you can no longer do, whether it’s sports, hobbies, or even spending time with your loved ones in the way you used to.

Emotional Distress

An injury doesn’t just affect your body—it impacts your emotions too. The stress of medical bills, anxiety from missing work, and frustration of losing activities you love can weigh heavily. Emotional distress is the toll of uncertainty and fear, leaving you feeling stuck in a situation that’s not your fault.

In Florida, the way your compensation is calculated doesn’t just depend on how badly you were injured—it also takes into account how much fault you share in the accident. This is where the comparative negligence rule comes into play. Simply, the comparative negligence rule means that if you're found to be partially at fault for the accident, the amount of compensation you’re awarded will be reduced by your percentage of fault.

For instance, let’s say you're awarded $100,000 by a jury after a car accident, but the jury finds that you were 20% responsible for the accident—maybe you were speeding just a little or didn’t notice a traffic signal change. In that case, your award will be reduced by 20%, which means instead of receiving the full $100,000, you’d only get $80,000.

I know, that might sound a little frustrating. But the good part is that the rule is designed to be fair. It's about making sure that everyone involved in an accident is held accountable for their actions, even if the accident wasn't entirely their fault.

Additionally, on lawsuits filed after March 24, 2023, there is a new rule in play called Florida’s modified comparative negligence 50% rule. If you, as the injured person, are found to be over 50% at fault for the incident or injury, a jury will be instructed to award you nothing. That’s right, zip zero zilch. That’s just another reason it is important not to talk to insurance companies or defendants after a loss and let an attorney start investigating right away. Although this new law is certainly unfair to injured people, it does not mean you do not have a case. It just means you need to have an experienced lawyer evaluate the case as soon as possible.

In Florida, you’re entitled to two key types of damages: economic and non-economic. However, navigating these claims, dealing with insurance companies, and ensuring everything is properly calculated can put in a lot of distress.

With Carter Injury Law on your side, we’ll make sure every dollar you're entitled to gets accounted for. We’ll work to ensure that your lost wages from missing work and any loss of earning capacity are fully recognized. Whether it’s negotiating with your insurance company or pushing for a fair settlement, we’re here to handle the details so you don’t have to. Plus, we'll make sure that your pain and suffering are fully considered when calculating your compensation.

If you or a loved one has been injured, don’t take the hurdles alone. Carter Injury Law offers no-cost, no-obligation consultation to explain your rights and options. Call us today to fight for the compensation you deserve.

If you’ve been in a car accident or suffered a personal injury, you might find yourself asking, “What sets one lawyer apart from another? Does it even matter?” It really does. The truth is, some lawyers shy away from the courtroom, avoiding the battle altogether. They take the easy road, chasing settlements that come quickly, not those that are just.

However, the fight for what you’re owed often demands something more: the courage to step into the arena, to face uncertainty head-on. It’s in that willingness to stand and fight where the real difference lies.

When it comes to personal injury cases, having an attorney who knows their way around the courtroom isn’t just helpful—it’s essential. Insurance companies aren’t in the business of handing out fair settlements unless they’re forced to take you seriously.

The reality is, until you file a lawsuit, the insurance company won’t look closely at your case. They won’t see the depth of your injuries or the weight of what you’ve endured. But the moment you serve that lawsuit, everything changes. The process begins—depositions, mediations, meetings with a judge. It compels them to confront the details, to reckon with what really happened and what it will take to set things right.

Without a lawyer willing to go to court, you're already at a disadvantage. You need someone who knows how to file a lawsuit and has the experience and resources to follow through. That’s how you make sure you’re not outmatched by the big insurance companies. In the end, it’s about evening the odds and ensuring you don’t settle for less than what you deserve.

When people hear the word “lawsuit,” it can feel overwhelming, but the truth is, the process isn’t as intimidating as it seems when you have the right attorney by your side. At our firm, we break it all down for you, step by step, so you always know what’s happening and what to expect.

It starts with filing the lawsuit. That’s when we formally notify the person responsible for your injury, and it sends a simple, undeniable message to the insurance company: We’re not backing down until you get what you’re owed.

From there, the case moves into what’s called discovery. This is where the real work begins. We take depositions , where we sit down with the other parties involved and ask them detailed questions about the incident. You’ll also have the chance to tell your story in a deposition, and we’ll make sure you’re fully prepared for it.

Next, there are mediations. This is where both sides come together with a neutral mediator to see if we can reach a fair resolution before heading to trial. It’s not about backing down; it’s about exploring every opportunity to settle on your terms.

If the case still doesn’t resolve, we go to hearings with a judge, presenting evidence and arguing on your behalf.

Through it all, our purpose goes beyond simply fighting the case—it’s about making sure you’re truly seen, truly heard. Representation isn’t just a matter of process; it’s a matter of dignity. We’ve walked this path many times before, navigating the examinations, the arguments, and the relentless machinery of the courtroom. It’s a weight we carry so you don’t have to, leaving you free to focus on what matters most—piecing yourself back together.

Not all attorneys are built the same, and unfortunately, some avoid litigation entirely. They might tell you they’ll handle your case, but when things get tough—when the insurance company refuses to pay what’s fair—they’re quick to push for a settlement. Why? Because filing a lawsuit takes time, money, and experience, and not every lawyer is ready to make that commitment.

Some attorneys will even refer your case out to another firm once it’s clear that a lawsuit is necessary. The problem with that? They’re financially incentivized to settle before it ever gets to that point. That means they may accept a lowball offer just to avoid the effort of filing and litigating. If an attorney is more focused on their convenience than your compensation, they’re not the right one for you.

At our firm, we don’t take the easy way out. We believe your case is worth the effort, the time, and the fight it takes to seek what’s truly fair. Because if your lawyer isn’t ready to take that stand, can you really trust them to fight for you at all?

Choosing the right attorney after a car accident or personal injury can feel overwhelming, but there’s one question that can cut through the noise: “What happens if my case doesn’t settle? Will you take it to court?” The answer you get can tell you everything about whether this attorney is the right fit for you.

Don’t be afraid to ask specifics. “Do you file lawsuits? How often? What’s your strategy when the insurance company lowballs my claim?” Their answer will tell you everything you need to know about their readiness to fight for you. A confident attorney will explain their process—how they handle lawsuits, what steps they’ll take, and how they’ll stand up to big insurance companies on your behalf.

The bottom line? Don’t settle for vague promises or excuses. An attorney who’s serious about your case will have a clear answer and a plan to get you the compensation. At our firm, we’re upfront about our commitment to fight for you—whether that means settling your case or taking it all the way to court.

The choice of a lawyer in your personal injury case isn’t a small thing—it’s everything. The right lawyer isn’t just your representative; they’re your voice when no one else will listen, the one who ensures your story is told and your rights are defended.

You deserve more than a compromise, more than silence. Don’t gamble with what’s ahead. Call us today for a free consultation. Let’s talk, face-to-face, about where you stand, where you could go, and how we’ll walk that road together.

What do you do if you’re involved in a car accident in Florida, and either you or the other driver has out-of-state insurance? It’s a common scenario here—Florida is one of the most visited states in the country. With Disney World, Miami, the Everglades, and even some great football teams, people from all over come here every day. Unfortunately, that also means a lot of accidents involve drivers who aren’t from Florida.

When insurance policies from different states come into play, the rules can get complicated. And if you’re dealing with an out-of-state insurance company, the laws of the state where the policy was issued could completely change how your claim is handled. That’s why it’s so important to talk to a lawyer early on—these cases aren’t as straightforward as they might seem.

Dealing with an accident involving out-of-state insurance can get complicated quickly. Every state has its own insurance rules, and those don’t just go away because the accident happened in Florida. Whether it’s your policy or the other driver’s, out-of-state coverage often works differently than what we’re used to here.

Take PIP coverage, for example. Some states require much higher limits than Florida, while others don’t require PIP at all. That means how your medical bills get paid can vary a lot depending on where your policy was issued. And it’s not just about coverage—filing a claim with an out-of-state insurance company brings its own challenges, especially if they don’t operate much in Florida.

There’s also the issue of where to file your case. If the insurance company does business here, you might be able to keep the claim in Florida. But in some cases, you could end up in federal court or even dealing with the state where the policy originated. These jurisdictional hurdles can be frustrating and time-consuming without the right help.

When the driver who hits you has out-of-state insurance, things can get even more complicated. In Florida, insurance companies are required by law to disclose how much coverage their policies provide. But not every state has those same rules. Some states, like Michigan, are non-disclosure states, which means the insurance company doesn’t have to tell us what the policy limits are.

This lack of transparency can make it harder to know what kind of compensation you’re dealing with. Sometimes, we might get a vague response over the phone, but even then, we won’t have a clear picture of how much coverage is available. That’s why identifying the other driver’s policy and limits as early as possible is so important.

Florida has a big problem with uninsured drivers, which is why uninsured motorist (UM) coverage is so important. If you’re hit by someone who doesn’t have enough insurance—or no insurance at all—UM coverage can step in to cover your damages. But here’s the catch: UM claims are governed by the laws of the state where your policy was issued, not Florida.

For example, Florida gives you 5 years to file a UM claim, but many states have much shorter deadlines—some as little as two years. If you miss that deadline, you could lose your ability to recover anything under your UM policy. That’s why it’s crucial to know the statute of limitations in your policy’s home state and take action quickly.

When it comes to filing a lawsuit for an accident involving out-of-state insurance, one of the biggest hurdles is deciding where to file your case. In some situations, you may be able to keep the case right here in Florida state court, especially if the insurance company does significant business in the state or if the other driver is a Florida resident.

But it’s not always that simple. If the other driver’s insurance company doesn’t do business in Florida, or if they’re headquartered in a state where they don’t have much presence here, you may have to file in federal court. In some cases, you could even end up needing to transfer the case to the state where the insurance policy was issued, adding a whole new layer of complexity to the process.

These jurisdictional issues are something you want to address from the get-go because they can significantly impact how your case progresses. Trying to navigate these challenges without legal experience could slow down your claim and make everything more complicated than it needs to be.

In cases involving out-of-state drivers and insurance, time is not on your side. The sooner you start, the better. First, you need to gather all the evidence—the details of the accident, medical records, and witness statements. The longer you wait, the harder it gets to track down witnesses or obtain vital documentation that can make or break your case.

Another time-sensitive issue is serving the defendant, especially when they’re from out of state. If the other driver goes back to their home state, tracking them down and serving them with legal papers can become a real challenge. But the earlier we get started, the sooner we can take action and secure compensation. Plus, it is less likely you are to miss important deadlines.

We’ve seen it all—the tangled mess of insurance claims, out-of-state companies playing games, laws contradicting each other, and uninsured drivers adding chaos to injury. It’s a maze, no doubt, but one we’re not afraid to navigate. Complexity doesn’t scare us; it fuels our resolve to fight for what’s rightfully yours.

When you come to us, it’s straightforward. No tricks, no hidden costs. We’ll sit down with you, talk it through, and evaluate your case—all without any obligation. You don’t owe us a dime unless we win. Life can feel heavy in moments like these, but you don’t have to carry it all alone. We’ll walk with you, step by step, clearing the path as we go.

If you’ve been in an accident in Florida, you might be wondering how to secure compensation for your injuries. Well, first of all, Florida has some pretty unique laws when it comes to personal injury cases, especially involving car accidents. For starters, Florida is a no-fault state, which means that your own insurance is going to be the first to cover your medical bills, regardless of who’s at fault.

But there are a lot of nuances to these laws that can impact how much compensation you actually receive. So, let’s break it down and help you understand what you need to do if you’re injured and seeking compensation in Florida.

Let’s break down how no-fault insurance works in Florida. When you're involved in an accident, your own insurance company steps in first to cover your medical bills. Think of it as a safety net that ensures you're not left scrambling for immediate financial help.

There are some key details to understand. If your injuries are minor, your insurance will cover 80% of your medical expenses, but only up to $2,500. However, if you’ve been seriously injured and require more extensive medical treatment, your coverage can increase, with your insurance paying up to $10,000 for necessary care.

While this coverage helps with your medical bills, it does have limits. Keep in mind, no-fault insurance only applies to medical expenses—it won’t cover lost wages, pain and suffering, or other types of damages you might face after an accident.

By knowing these limits upfront, you can better prepare for the next steps, especially if your injuries go beyond what your insurance can cover.

Now, let’s get into the more complex part. In Florida, determining who’s at fault for an accident is taken very seriously.As of march 2023, If the jury finds that you’re more than 50% responsible, you may not receive any compensation at all—yes, that means zero.

That’s why it’s crucial to document everything related to the accident. Take photos of the scene, gather witness statements, and keep a detailed record of your injuries. This will help build your case and show that the other driver was primarily at fault.

If the insurance company tries to place the blame on you, you need to be prepared to push back. That’s where we come in. We can assist you in collecting evidence and negotiating with the insurance company to ensure you get the fair compensation you deserve.

Okay, so you've been in an accident, and now you need to build a strong case to get the compensation. Let's break down what that means.

First, it's important to document everything you can about the accident. Take pictures of the scene, get witness statements, and keep track of your injuries. This will help prove your case and show that the other driver was mostly at fault.

Second, you need to gather medical records and bills to show the extent of your injuries and the treatment you've received. This can include doctor's notes, hospital bills, and any other medical documentation.

Third, if you can't work because of your injuries, you'll need to document your lost wages. This might include pay stubs, time cards, or a letter from your employer.

Finally, you might need to hire a private investigator to gather additional evidence, especially if the other driver is denying fault.

Remember, the stronger your case, the better your chances of getting fair compensation. So, don't be afraid to gather as much evidence as you can.

One critical aspect you need to be aware of is Florida’s statute of limitations. This refers to the legal time frame in which you can file a lawsuit after being injured. In Florida, that time limit is now set at two years. What this means is that you have exactly two years from the date of your injury to pursue legal action. If you fail to meet that deadline, even if your case is strong, the courts won’t hear it, and the insurance companies will likely reject your claim without question.

There are some exceptions to this rule, such as in wrongful death cases, but for most personal injury claims—including car accidents, slip-and-falls, or other types of injuries—the two-year statute of limitations applies. That’s why it’s so important not to wait too long to take action. The longer you wait, the harder it becomes to gather evidence, secure witness statements, and build a solid case. Acting quickly not only ensures you stay within the legal time frame, but also strengthens your chances of receiving the compensation.

We know that your case is more than just paperwork — it's your life, and you're going through a lot. That’s why we’re here to take as much stress off of you as possible. We don’t just handle your case; we guide you every step of the way. From helping you gather the right documentation to dealing with the insurance companies, our goal is to make this process as smooth and stress-free as it can be for you.

We understand how overwhelming this can all feel, but you’re not alone. We’re here to fight for your rights and make sure you get the compensation. We also offer a free consultation. This means you can learn more about your case and our services without any obligation. We’re ready to help you navigate through this and get you the best possible outcome.

If you’ve been injured in Florida and you’re seeking compensation, don’t wait. Give us a call at Carter Injury Law today. We offer a free, confidential case evaluation, so there’s no risk in reaching out to see how we can help. And remember, you won’t pay a dime unless we win your case.

You’ve been through enough already — let us handle the legal side. Contact us today as there is no risk in calling us as everything is attorney client privilege.

What do you do if you get into a car accident in Florida, but your insurance policy is from another state? This happens more than you think. Florida sees a ton of visitors from all over—whether it’s tourists, snowbirds, or people down here for work. A lot of people come in with insurance from places like Illinois, Michigan, or North Carolina.

When your policy isn’t from Florida, things can get complicated. That insurance policy is a contract between you and the insurance company, However, it’s governed by the laws of the state where it was issued and the statute of limitations will be different. That means the rules you’re used to—like how long you have to file a claim—might be completely different here. And if you don’t know those differences, you could miss out on benefits or even have your claim denied.

When you have an out-of-state insurance policy, remember it’s a legal contract governed by the laws of that state, not Florida’s. If you’re in an accident here, Florida rules won’t automatically falls well alligned with you due to the difference of the corresponding states.

This is where things can get confusing. For example, every state has its own statute of limitations—that’s the deadline for filing a claim. Some states might give you two years; others might give you four. But if you don’t follow the timeline set by the state where your policy was issued, you could lose your right to make a claim altogether. It’s not uncommon for people to assume they have time, only to find out later that their deadline has already passed.

That’s why having someone with the required legal knowledge on your side is crucial. An experienced attorney can help you understand what the policies are all about and ensure you meet all requirements so your valid claims will not be denied.

When you file a claim after an accident, the insurance adjuster is going to ask you a bunch of questions. At first, these might sound routine—almost like small talk—but make no mistake, they’re gathering information to figure out if they can deny your claim.

They might ask things like:

How long has your car been in Florida?

What was the purpose of your visit?

Were you just visiting or have you moved here?

Were you driving for Uber, Lyft, or another company when the accident happened?

Now, you might be thinking, Why does any of this matter? After all, you got hit, you’re hurt, and you just want your claim processed. But here’s the thing—these questions are designed to find loopholes in your policy.

For example, if you’ve had your car in Florida for an extended period but haven’t updated your insurance or registration, they might argue that your coverage is invalid because your policy is based in another state. If you were driving for a rideshare service or delivering for a company at the time of the accident, the adjuster might try to claim that your personal insurance doesn’t apply, forcing you to go through commercial insurance instead—which can complicate things even more.

This is exactly why having an attorney on the phone with you during these conversations is so important. We know what they’re trying to do, and we won’t let them twist your answers into something that works against you. We make sure that every question is answered in a way that protects your rights and gives you the best chance of getting the benefits.

One of the biggest things to know is that not every insurance policy works like Florida’s. Florida has what’s called no-fault personal injury protection (PIP) coverage, which helps cover your medical bills, no matter who caused the accident. But not all states do things the same way. If your insurance is from a different state, it might not include PIP at all. Instead, some policies offer medical payments coverage (also called “MedPay”), which works differently.

MedPay policies are designed to cover your medical expenses up to a specified limit, however, they may only activate right after other insurance has been exhausted. In contrast, Personal Injury Protection (PIP) provides immediate coverage, making the claims process simpler. If you are unfamiliar with how your out-of-state policy operates, you risk incurring out-of-pocket costs for expenses that should be covered by your insurance.

Our team will identify any gaps in your policy and strategize the best ways to maximize your coverage. It’s easy to overlook critical details in the fine print, but that’s precisely why we are here—to ensure you receive the full benefits to which you are entitled and avoid being shortchanged.

We’ve handled plenty of cases involving out-of-state insurance policies, so this isn’t something new for us—we know the process inside and out. Dealing with different state laws, unfamiliar policies, and adjusters who are trying to deny or delay your claim can certainly get overwhelming. That’s where we come to make the process as smooth as possible for you.

The reality is that out-of-state insurance companies often create complexities in the claims process. You shouldn’t have to worry about the fine print or figuring out which benefits you’re entitled to—we’ll take care of that. If your policy offers medical payments coverage instead of Florida’s no-fault PIP, we’ll explain how it works and ensure those benefits are applied the way they should be.

Our goal is to make sure you get everything you’re entitled to under your policy. We know how to push back when insurance companies try to cut corners or deny valid claims, and we’ll fight to get you the full benefits you deserve. With us in your corner, you can focus on recovering, and we’ll handle the rest.

One thing I always tell people: there’s no reason to hesitate about giving us a call because we don’t charge anything upfront. When you’re dealing with an accident—especially in a situation where your insurance is from another state—the last thing you need is to worry about legal fees. That’s why we only get paid if we win your case. If we don’t recover anything for you, you owe us nothing. It’s that simple.

Carter Injury Law also covers all the costs that come with handling your case—things like paperwork, court filings, and expert consultations. You’re not paying out of pocket for any of that. All of the time and resources we put into your case? We front those costs because we believe in your claim, and we’re confident we can get you what you deserve.

A lot of people ask me, "David, how do I stay calm when dealing with an insurance adjuster after an accident?" It’s a totally valid question, and trust me, you’re not alone in feeling overwhelmed. After an accident, emotions run high, and suddenly, you're faced with a cold, calculated corporation that seems to care more about their bottom line than your well-being.

Navigating this process can be confusing, especially if you’ve never been through it before. That’s why I want to take a moment to share some insights on how to handle these situations with confidence. This post is all about helping you stay calm and informed when talking to insurance adjusters, so you can focus on what really matters—your recovery.

When you're dealing with an insurance adjuster, it's essential to understand their primary function: minimizing payouts for the insurance company. They’re not there to help you; their goal is to protect their employer’s interests. While it may seem like they’re on your side, asking questions and gathering information, their real aim is often to find ways to deny your claim or offer you the lowest settlement possible.

Insurance companies operate in a cold, calculated environment where the bottom line reigns supreme. When you reach out for assistance after an accident, you might find yourself treated as just another file in a stack, another case to be resolved quickly and cheaply. This corporate mindset affects how adjusters interact with you. They may come off as indifferent, pushing for quick answers instead of taking the time to understand your unique situation.

This is why having an attorney by your side is so crucial. We ensure that you're treated as an individual, not just another statistic in their profit-and-loss report.

So, why should you reach out to an attorney before speaking with an insurance adjuster? It’s simple: you have an obligation to understand your rights. After an accident, you might feel rushed to give statements or answer questions, but trust me, taking that step back is crucial. An attorney will help you navigate the complexities of the claims process and ensure that you’re fully aware of your rights and options before you engage with the adjuster.

When you become a part of our family, you can rest easy knowing that an experienced attorney will be with you during every conversation with insurance adjusters. We believe in a hands-on approach, which means we don’t just give you the tools and send you on your way—we actively participate in those discussions. You won’t have to worry about the intricacies of legal jargon or feeling pressured into making hasty decisions. We’re here to take that burden off your shoulders so you can concentrate on getting better.

Before you even pick up the phone to speak with an insurance adjuster, I want you to take a moment and breathe. It’s essential not to rush into these conversations, especially when emotions are running high. Accidents are traumatic experiences, and the last thing you need is to add unnecessary stress by feeling pressured to respond immediately.

Take a step back and give yourself some time to collect your thoughts. If you’re feeling devastated, reach out to your attorney first. We’re here to guide you through the process and help you formulate a plan. Remember, you have every right to pause and prepare before diving into a conversation that could impact your future.

When it’s time to talk to the adjuster, there are a few points to keep in mind to ensure you’re communicating effectively:

Provide Only the Necessary Facts: Stick to the basics. The adjuster doesn’t need to know every detail of your life story. Share only the information that is relevant to the claim. The more you say, the more opportunity there is for misinterpretation or manipulation.

Treat the Conversation Like a Business Transaction: This isn’t a friendly chat; it’s a business negotiation. Approach it with a professional mindset. Keep the tone formal and focused. This helps you maintain control over the conversation and reinforces the importance of your claim.

Avoid Personal Emotions; Focus on Your Rights: It’s natural to feel emotional after an accident, but try not to let those feelings drive your conversation. Adjusters may use emotional appeals to sway you, so it’s crucial to stay grounded. Focus on what you know about your rights and the compensation you need. Remember, you have the right to advocate for yourself, and an experienced attorney can help ensure those rights are respected.

One tactic that many insurance companies, including Progressive, use is what I call the “swoop in” approach. After an accident, you might receive a call from an adjuster offering you a quick settlement. It might sound tempting—after all, who doesn’t want to resolve things quickly? But let me tell you, this is a red flag. They’re swooping in while you’re still reeling from the accident, trying to get you to sign off on a settlement before you even have a chance to fully understand the extent of your injuries or your claim.

This approach is designed to catch you off guard and make you feel like you’re getting a good deal. In reality, it’s a tactic to minimize their costs. They’re hoping you’ll be so eager to put this behind you that you’ll accept whatever amount they throw at you, even if it’s far less than what you truly deserve.

Signing an early settlement can have serious consequences. Once you accept that offer and sign on the dotted line, you’re essentially closing the door on any future claims related to that accident. This means you could miss out on fair compensation for your injuries, medical expenses, lost wages, and even pain and suffering.

Many people don’t realize how their injuries can evolve over time. You might feel fine right now, but what happens when that pain resurfaces weeks or months down the line? Accepting a low settlement too soon could leave you financially strapped when you discover that your injuries require ongoing treatment or when you can’t work due to your condition.

When you choose Carter Injury Law, you’re not just hiring an attorney; you’re gaining a partner who genuinely cares about your situation. Unlike big insurance companies that see you as just another number, we recognize you as an individual with unique needs and challenges. That personal touch is what sets us apart.

Think of us as your sports agent. Just like a superstar athlete wouldn’t negotiate their own contract, you shouldn’t have to tackle the complexities of dealing with insurance adjusters alone. Our team steps in to advocate for you, negotiating terms and handling tough conversations to ensure your best interests are represented.

As your attorney, we wholeheartedly commit to fighting for the compensation you deserve while you focus on your recovery. With our knowledge of the legal system and effective negotiation skills, you can relax, knowing we’re in your corner, pushing for the best possible outcome on your behalf.

In closing, I want to reiterate just how crucial it is to have an attorney by your side after an accident. Legal representation isn’t just about navigating the complexities of insurance claims; it’s about relieving the stress that comes with it.

Don’t hesitate to reach out. If you’re feeling uncertain about how to proceed, I encourage you to contact our law firm for a free case evaluation. It’s completely risk-free; we don’t charge any fees unless we win your case. Let us take the burden off your shoulders and guide you through this process with the care and attention you deserve. You don’t have to go through this alone—call us today, and let’s get started on your path to recovery.

When you're involved in a car accident, it’s easy to make mistakes that can really hurt your claim. We see it happen all the time—people wait too long to act, skip medical care, or try to handle everything on their own. These pitfalls can cost you the compensation you deserve. But the good news is, most of these mistakes are avoidable if you know what to do.

In this post, we’re going to walk you through the most common pitfalls we see in Florida car accident claims and, more importantly, how to avoid them. Whether you’re just getting started with your claim or you’ve already run into a few of these issues, we’re here to help.

One of the biggest mistakes people make after a car accident is waiting too long to take legal action. In Florida, the statute of limitations for filing a personal injury claim is two years. That might sound like plenty of time, but it goes by fast—especially if you’re busy dealing with injuries, car repairs, or figuring out insurance. If you let those two years pass, your case is barred, meaning the court won’t even hear it. You lose your chance to get any compensation, no matter how serious your injuries are.

We see this happen all the time. People call us three, four, even six years after their accident and say, “Hey, I’ve been in pain all these years, but now I’m ready to do something about it.” Unfortunately, there’s nothing we can do at that point—it’s simply too late. It’s frustrating for them and for us because we want to help, but the law is clear. Once the deadline passes, you can’t reopen the case or get any compensation, no matter how strong your claim might have been.

The key takeaway here is to act quickly. The sooner you start the process, the better off you’ll be. Even if you're not sure about filing a lawsuit, it's important to begin so you can keep your right to do so later. Waiting until the last minute—or missing the deadline entirely—is one of the most common mistakes we see, and it’s easily avoidable.

If you’ve been injured, don’t hesitate to reach out to us now. We’re here to help protect your rights and ensure you don’t miss any important opportunities. Time is important, and taking action now can make a significant difference in your case.

Another common mistake people make after a car accident is waiting too long to see a doctor. If you’re injured, you need to get checked out right away—don’t wait days, weeks, or months. The longer you wait, the easier it is for the insurance company to argue that your injuries aren’t as serious as you say, or even that the accident didn’t cause them at all. They’ll use any gap in your medical care to low-ball your claim and pay you way less than you deserve.

We’ve seen it happen plenty of times. Someone feels sore or in pain after an accident but thinks, “It’ll go away on its own.” Then, months later, when the pain gets worse and they finally see a doctor, the insurance company turns it against them. They’ll say, “If you were really hurt, you would’ve seen a doctor right away.” And just like that, your case gets devalued.

If you’re in pain, go see a doctor. It doesn’t matter if you go to the hospital, urgent care, your primary care physician, or even a chiropractor—just make sure you get treated by someone who knows what they’re doing. What’s most important is that you document everything. When you see the doctor, tell them exactly what hurts and how the accident happened. Don’t leave anything out, even if you think it’s minor—those small details could matter later.

A big mistake we see people make is trying to handle their car accident claim on their own. They think they can deal with the insurance company directly and everything will work out fine—but that’s rarely the case. The truth is, insurance companies are not in the business of paying out fair settlements. Their goal is to save their company money, not take care of you. And the adjusters? They might seem friendly, but they’re trained to limit what you get paid.

When people try to go through the process without a lawyer, they often run into trouble. They miss important details, run into legal loopholes, or deal with doctors who won’t support their case. Then, by the time they come to us, we take one look and think, “Man, this could’ve been handled so much better.” Sometimes, there’s only so much we can fix because mistakes were made early on. That’s why we always say, “Never go it alone.”

We know what loopholes the insurance company will try to use, and we’ve dealt with adjusters and doctors who aren’t sympathetic to accident victims. Having someone on your side who understands the ins and outs of these claims can make all the difference. There’s a lot more to it than just filling out paperwork—you need to know how to protect your rights at every step.

The best part? There’s no risk to you. We work on contingency fees, which means you don’t pay us anything unless we win your case. So there’s no reason not to hire an attorney. You get the legal support you need without any upfront cost. We’re here to make sure your case is handled the right way from start to finish—because if you try to do it on your own, the insurance company will take advantage of that every time.

One of the biggest mistakes you can make after an accident is talking to the insurance company without having an attorney by your side. People think they’re just sharing what happened, but every word you say can come back to hurt your case. Adjusters are trained to gather information in ways that benefit the insurance company, not you. Even if you’re being honest and cooperative, they can twist your words or take things out of context to downplay your injuries and lower your payout.

Adjusters ask seemingly harmless questions like, “How are you feeling today?” If you respond with, “I’m doing okay,” they’ll use that to argue that you weren’t seriously injured. Or they’ll throw in questions that don’t even matter, hoping you’ll say something inconsistent that they can use to challenge your claim later on. It’s like the old saying: “Anything you say can and will be used against you”—except here, it’s the insurance company that’s listening.

We know exactly how to handle these conversations. We coach you on what to say so you don’t accidentally hurt your case, and we block questions that aren’t relevant or that could trip you up. Sometimes, we can even take over communication entirely so you don’t have to deal with the adjuster at all.

The bottom line is, without an attorney, it’s easy to say the wrong thing or give them information they’ll twist to pay you less. But when you have us in your corner, we protect you from their tactics and make sure nothing gets said that could harm your case down the road.

One of the biggest traps we see people fall into is accepting the first settlement offer the insurance company throws their way. It’s important to understand that the first offer is almost never the best offer. Insurance companies are trying to close the case as quickly and cheaply as possible. They know that the longer a claim stays open, the more likely it is that the injured person will discover the full extent of their injuries—and that could mean a bigger payout for them.

So, what do they do? They swoop in with a lowball offer right after the accident, hoping you’ll take it before you realize just how injured you are. It sounds tempting—especially when you’re stressed, dealing with medical bills, and just want everything to be over. But If you accept that early offer, you release your claim. Once you sign off, you can’t go back and ask for more compensation—even if you find out later that your injuries are worse than you thought.

We’ve seen it time and time again. Someone takes a quick settlement for a few thousand dollars, thinking it’ll cover everything. Then, a few months later, the pain gets worse, or a new injury shows up, and suddenly they’re facing expensive treatments or surgeries. But by that point, it’s too late. The claim has already been settled, and there’s no way to reopen it. The insurance company has what they wanted—a closed case—and you’re left footing the bill for the care you really needed.

This is why it’s so important to consult with an attorney before accepting any settlement offer. We know what your case is actually worth and can negotiate a fair settlement that reflects the true extent of your injuries, lost wages, and future medical expenses. An early settlement might feel like a quick solution, but it’s usually not in your best interest. We’ll make sure you don’t get shortchanged and that the compensation you receive covers everything—both now and in the future.

If you have any questions or think you may have fallen into one of these traps, don’t hesitate to reach out. Call us today for a free, confidential consultation. We’re here to help you navigate this challenging time and ensure you get the support you need to move forward. Your rights matter, and we’re ready to fight for them.

If you’re here, chances are you or someone you care about has been injured. First and foremost, I want to say that I hope you’re okay, that you’re safe, and that you’re surrounded by people who care about you. Whatever happened, you’re not alone—and you’ve come to the right place.

At Carter Injury Law, we know how overwhelming things can feel after an accident. You’ve probably got a lot of questions, and we’re here to help you find the answers. Our firm isn’t just about handling cases—we’re about supporting people.

I was born in St. Petersburg and raised in Tampa, Florida. This community has shaped who I am, and I’ve spent my career giving back to the people here. My journey in law started early—as a fifth-generation attorney, I knew from a young age that I wanted to be in the courtroom, fighting for justice.

After graduating from Jesuit High School in Tampa, I earned a Bright Futures Scholarship to attend the University of Florida, where I graduated from their Honors Program. I later went on to earn my law degree from the Florida State University College of Law, graduating with honors.

My passion has always been about standing up for people—especially when they’re up against powerful insurance companies and corporate interests. That’s what led me to the personal injury field.

I began my legal career at a large personal injury firm, where I gained invaluable experience helping clients achieve the results they truly deserved. It was rewarding work, but deep down, I felt something was missing. I longed for a connection that went beyond simply handling cases; I wanted to forge genuine relationships with my clients and truly understand their struggles.

That’s why I made the heartfelt decision to join a boutique firm, where I could focus on building meaningful relationships with the people I represented. Yet, after a while, I found myself drawn back to the larger firm. It didn’t take long for me to realize how much I missed treating clients like family, rather than just numbers in a system.

This longing for connection led me to start Carter Injury Law. My goal was clear: to create a law firm that puts people first—a warm, welcoming place where clients feel heard, respected, and genuinely cared for.

At Carter Injury Law, we handle a wide range of personal injury cases. If you’ve been injured, we can help you with:

Car Accidents: We’re Here to Get You the Compensation

Getting into a car accident is overwhelming—whether it’s a fender bender or something more serious. Maybe you were hit by a distracted driver or got hurt while riding in an Uber or Lyft. No matter the situation, accidents happen fast, and suddenly, you’re left dealing with injuries, insurance claims, medical bills, and repair costs.

We’ve seen it all. We know how the insurance companies operate and the tactics they use to avoid paying claims. Whether it’s arguing over fault or offering you a lowball settlement, they’ll try everything to pay as little as possible. Our job is to make sure that doesn’t happen.

Slip and Fall Injuries: We Hold Negligent Parties Accountable

A slip and fall can happen when you least expect it—maybe you’re shopping at the grocery store, walking through a parking lot, or visiting someone’s home. One moment everything feels normal, and the next, you’re on the ground in pain, trying to figure out what just happened. It might seem like “just an accident,” but many times these falls happen because someone didn’t take care of their property the way they should have—whether that’s failing to clean up a spill, leaving a dangerous surface unmarked, or not fixing a hazard that was obvious to them.

If someone else’s negligence caused your injury, we’ll make sure they’re held accountable. We know how these cases work, and we won’t let the insurance companies brush your case aside or try to offer a quick, unfair settlement. We’ll gather the evidence, talk to the witnesses, and make sure your story is heard.

Medical Malpractice Cases: When a Healthcare Provider’s Mistake Changes Your Life

When we go to a doctor, nurse, or hospital, we put our trust in them. We assume they’ll do what’s right, follow the proper procedures, and help us heal. But sometimes, things go wrong. A misdiagnosis, a surgical mistake, a medication error, or even a negligence can turn what should have been a path to recovery into a life-changing ordeal. When a medical professional’s error leaves you worse off, it feels like a betrayal—and it’s not just about the physical injury. It’s about the emotional, financial, and mental distress it takes on you and your family.

At Carter Injury Law, we know how overwhelming it is to navigate life after a medical mistake. You’re dealing with more doctor visits, hospital bills, lose of probable wages, and the frustration of not knowing who to hold accountable. On top of that, healthcare providers and their insurance companies don’t make it easy. They’ll have teams of lawyers working to protect them, often claiming, “These things happen” or “We followed the standard of care.” Our job is to push back against that narrative.

We’ve been through this process before, and we know how to investigate medical malpractice cases thoroughly. We’ll dig into the details—review medical records, consult with experts, and gather the evidence needed to prove that the healthcare provider’s negligence caused your injury. Our goal is to make sure you get the right amount of compensation you need for medical costs, future care as well as the pain and agony you’ve endured.

Workplace Injuries: Protecting Your Health, Wages, and Future

Getting injured on the job can throw your whole life off track. It’s not just about dealing with the pain—it’s about figuring out how to cover medical bills, missing work and losing wages, and worrying about how your injury might impact your future. Whether you work on a construction site, in a warehouse, or in a corporate office, accidents can happen anywhere. Maybe you slipped on a wet floor, were hurt by faulty equipment, or were involved in a heavy machinery accident. No matter the situation, if you were injured while doing your job, you have rights—and we’ll make sure you get what you’re entitled to.

We’ll handle the paperwork, deal with the insurance companies, and make sure your claim is properly filed so you don’t miss out on any benefits. If your employer or their insurance provider tries to deny or reduce your claim, we’ll fight back. Beyond just medical bills, we’ll make sure you’re compensated for lost wages, future income loss, pain and suffering, and any other damages.

We understand that each case is unique and personal. you’re not just a client—you’re a person with a story. That’s why we offer a free, confidential case evaluation. Whether you’re ready to move forward with a claim or just have some questions, we’re here to help. There’s no pressure and no obligation—just a conversation to explore your options.

When you work with us, you’ll never feel like just another case in a pile. We’re all about modern connections and open communication, which is why I share my personal cell phone number with anyone who wants it. Need to talk? Reach out anytime—I’m just a text or call away.

At Carter Injury Law, you’re not just a file or a number—you’re important to us. We know how challenging it can be to go through something like this, and we’re here to walk with you through every step of the process.

If you or a loved one has been injured, don’t hesitate to reach out to us. We’re here to answer your questions, provide guidance, and help you secure personal injury compensation.

You can call us at 813-922-0228, send us an email, or fill out the form on our website. We understand how important your case is, and we’ll get back to you as soon as possible. To us, you’re not just another case—you’re family.

Have you ever felt the sinking feeling in your stomach after a car accident? The fear, the confusion, and the worry about insurance coverage can be enormous. Many of us assume that "full coverage" means we're completely protected, but the truth is often far more complex.

In Florida, the term "full coverage" can be misleading. It doesn't necessarily provide the comprehensive protection you might think. Understanding what full coverage actually means and how it can impact your financial situation is pivotal.

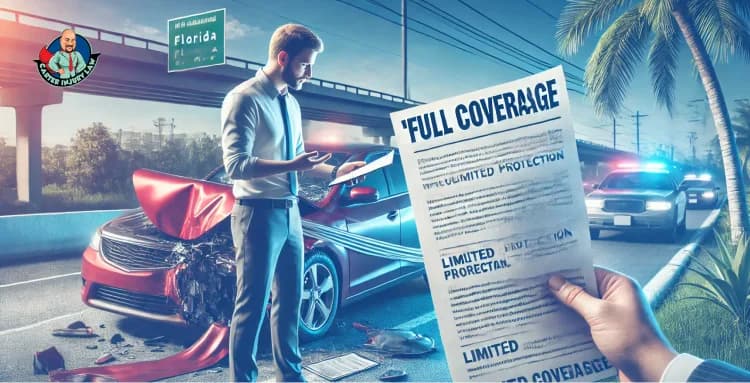

Let’s set the record straight—“full coverage” is kind of a misnomer. There’s really no such thing as full coverage, at least not in the way most people think. What one person considers full coverage could mean something completely different to someone else.

For instance, if you’re worth $100, you probably don’t need the same level of coverage as someone worth $100 million. It’s all relative. To truly be "fully covered," that person with $100 million would need a ton of insurance, likely in the millions, to feel secure. Meanwhile, someone with less might feel fully covered with a much smaller policy.

The bottom line is, there's no insurance that covers everything. What you really need depends on your financial situation, the risks you're willing to take, and what you're looking to protect. So when you hear “full coverage,” don’t take it at face value—there’s always more to it.

In Florida, the term "full coverage" can technically be applied if someone has the bare minimum insurance required by law. But don’t be fooled—just because someone meets these requirements doesn’t mean they’re fully protected.

Here’s what Florida law mandates: you need $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage coverage. That’s it. If you’ve got these two boxes checked, you can say you have “full coverage”—but is that really enough?

Not even close. PIP will only cover some of your medical bills, lost wages, or maybe even mileage to get to doctor appointments. And the property damage? Well, that’s just for damages to someone else’s car. So if you’re involved in an accident and someone tells you, “Don’t worry, I’ve got full coverage,” don’t relax just yet. These minimums aren’t going to cover everything—and certainly not enough if serious injuries or significant damage come into play.

So, what does it mean to be truly “fully covered”? Well, it goes way beyond just the minimums. If you want real peace of mind on the road, you need to look at a few other types of coverage that protect you in different situations.

First up, there’s Collision Coverage. This one’s very important because it pays for damages to your car, no matter who’s at fault in an accident. Whether you rear-end someone or get hit by a distracted driver, collision coverage makes sure you’re not stuck paying for repairs out of pocket.

Then there’s Comprehensive Coverage. This handles those random events that aren’t accident-related. Think about a tree falling on your car during a storm or someone vandalizing your vehicle. If you don’t have comprehensive coverage, you’re covering those costs yourself.

Next, we have Bodily Injury Coverage. This is important because it protects others if you’re the one at fault in an accident. If you cause injuries to someone else, bodily injury coverage helps pay for their medical bills and other expenses, so you're not personally on the hook for those costs.

Don’t forget about Uninsured Motorist Coverage. Unfortunately, not everyone on the road has the proper insurance—or enough of it. If you get hit by someone without coverage or with too little insurance, uninsured motorist coverage steps in to protect you. It ensures that you’re not left paying for damages or injuries caused by someone else’s lack of responsibility.

You might also want to think about Rental Coverage. If your car needs repairs after an accident, rental coverage makes sure you can get a rental car while yours is in the shop. It’s a small thing, but it makes life a lot easier when you’re not scrambling for a ride.

Finally, there’s the Umbrella Policy. This is extra protection that goes beyond your bodily injury limits. So if you’re facing a serious claim where the damages exceed your policy’s limit, the umbrella policy can cover the excess.

So, when someone says they have “full coverage,” I have a lot more questions. True full coverage means having a mix of all these types of insurance to cover you in any scenario—accidents, storms, vandalism, and more. Anything less, and you're leaving yourself exposed.

Here’s the thing—when someone says, “I have full coverage,” it doesn’t really tell you much at all. Sure, they might have the basic requirements, but that doesn’t mean they’re fully protected or that you’re covered in the event of an accident.

First off, just hearing "full coverage" doesn’t explain what types of insurance they actually have. They could have the bare minimum, like the $10,000 in PIP and $10,000 in property damage, and still claim they have full coverage. But what about bodily injury coverage? What about uninsured motorist coverage? Those are the real game-changers, and if they’re missing, you could be left high and dry.

One thing you can do is take a look at their insurance card. Sometimes, you’ll see boxes checked off, and if there’s a check next to "bodily injury coverage," that's a good sign. It means they have some level of coverage to protect you if they’re at fault. But here's the catch: just because a box is checked doesn’t always mean you’re in the clear. The only way to know for sure is to verify the policy.

This brings us to a critical step—always involve the police at the scene of an accident. I can’t stress this enough. Having the police document the incident ensures that everything is on record. When the police get involved, they can verify the insurance details, so you’re not relying on the other person’s word alone. Why is this important? Because, unfortunately, people sometimes hand over fake insurance cards at the scene. If you don't call the police, you might end up with nothing when you try to file a claim.

So, while "full coverage" might sound reassuring, don’t take it at face value. Without seeing the actual policy or getting verification from the police, it’s just words.

Want to learn more? Here are some related posts:

(I) Protecting Your Rights After a Multi-Car Collision: Tips from a Florida Attorney

(II) Staying Calm with Insurance Adjusters After an Accident

After an accident, understanding what insurance coverage you or the other party has can be overwhelming. That’s where we step in to take the guesswork out of the process and make sure you know exactly where you stand.

Once you hire us, we don’t waste any time. The first thing we do is send a letter to both insurance companies—yours and the other party’s—asking for a copy of the insurance policy and their declarations. Under Florida law, they have to give us that information. What we’re looking for here is a complete breakdown of all the coverages, so we know exactly what kind of protection is in place.

This is important because the insurance card alone won’t give you the full picture. What we need to see are the declarations pages, which tell us what types of coverage are included and how much coverage is available. We look at everything—PIP, property damage, bodily injury, uninsured motorist, you name it. These documents will tell us what’s real and what’s just talk when it comes to "full coverage."

Once we have those details, we’ll show you what coverages you have and what coverages the other party has. And if there’s anything missing, like uninsured motorist or bodily injury coverage, we’ll explain what that means for your case.

But we don’t stop there. We also look at your policy to make sure you’re not missing any critical protections. If we spot gaps in your coverage, we’ll let you know and walk you through options for what you might want to add in the future. We’re not just here to handle the aftermath of an accident—we want to make sure you’re protected moving forward, too.

If you’re feeling unsure about your insurance coverage—or the other person’s—don’t try to figure it all out on your own. Don’t guess, call us. We’ll get the real answers by reviewing the policies and explaining exactly what coverage is available.

We offer a free, confidential case evaluation, so you’ve got nothing to lose by reaching out. And here’s the best part—you don’t pay us a dollar unless we win your case. It’s that simple.